2015 Economic & Market Update: It’s All About the Numbers

February 1st, 2016 | Work to Wealth

It’s All About the Numbers

Assessment of the economy, the markets and how it relates to you.

Uncertainty about the domestic economy, the global economy, and the future of monetary policy resulted in a significant shift in sentiment in 2015. The anticipation of the FOMC’s (Federal Open Market Committee) decision to raise interest rates, the slowdown in global growth, and the resulting decline in oil triggered an increase in risk and volatility worldwide. To better understand the context of this change, a review of central bank policy from the beginning of the crisis is necessary.

In response to the Financial Crisis of 2007/2008, a coordinated effort by developed countries’ central banks flooded the major economies of the world with excess liquidity in order to drive down interest rates. The plan was enacted to restore stability and confidence in the markets and revive economic growth. I argue the result of this worldwide coordinated effort was a misallocation of resources, a distortion of prices, and a buildup of excess capacity, particularly in the emerging economies of the world.

Signs of a complete system failure began in 2007 when the mortgage market collapsed. Then in March 2008 Bear Stearns, an 85 year old company that was the fifth largest investment bank in the world, went from a supposedly healthy state to being auctioned off to JP Morgan Chase in a last ditch effort to avoid bankruptcy. In September of 2008, the US Treasury seized control of Freddie Mae and Freddie Mac. The two quasi-governmental companies required $200 billion in capital injections due to losses from mortgage defaults. A week later, AIG was bailed out in the amount of $85 billion. Next, Lehman Brothers was forced into bankruptcy because the financing needed to provide financial support, dried up. From that point, the mortgage market completely collapsed alongside some of the largest financial companies in the world.

The world’s markets were thrown into turmoil as credit markets froze due to a spike in fear and a lack of confidence. The Treasury and the Federal Reserve were called upon to devise a bailout plan to restore the function and the confidence in the markets by stepping in as the “lender of last resort”. Fortunately, the actions taken by the Treasury, the Federal Reserve and signed into law by President Bush staved off a complete collapse in the markets. The events of 2007 and 2008 represented the worst economic downturn since the Great Depression.

Months later, the markets were still in turmoil over the near collapse of the entire system. The FOMC had already dropped the federal funds rate to zero percent and the committee had used all of their other conventional tools to arrest the markets’ slide. That is when the FOMC unveiled its first Quantitative Easing (QE) since the Great Depression; a package of $800 billion to buy bonds to bolster lending and to support the flailing housing market. The initial policy response was considered massive in scale but a follow up response, just a few months later, would bring the program total into the trillions of dollars.

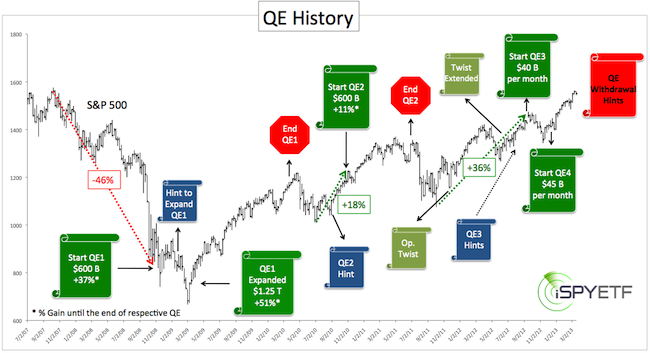

With the FOMC having instituted ZIRP (Zero Interest Rate Policy) and the Treasury buying trillions of dollars worth of bonds this resulted in excess liquidity or cash in the markets, which was intended for lending purposes and economic growth. Three more substantial responses, were all deemed necessary to help continue to restore stability in the economy and to provide support and confidence in the markets over the next four years. However, I argue that the excess cash mostly flowed into risk assets or stocks. This is based on years of evidence as illustrated in the chart below. It shows a tight correlation between QE and rising stock markets versus no QE and declining stock markets. Ultimately, QE policy was supporting the stock market and not the economy as initially planned.

During this process, when the FOMC even suggested a withdrawal of monetary support for the economy, the markets reacted negatively, as seen at the end of QE1 in March 2010 where the market lost 13% in just four months. Shortly after the markets’ negative response, a new round of support was hinted by then Chair Bernanke. Almost immediately, the markets rallied substantially from their lows before the next round of QE was even officially announced by the committee. Subsequently, with each declaration of support, the markets reacted positively. In 2013 however, the FOMC announced their decision to finally begin policy normalization, or the withdrawal of support beginning in 2014. The committee was confident that the economy was strong enough to continue to grow without the complete stimulus package. Therefore, they decided to first only reduce the bond buying program as a starting point to a more conventional monetary policy.

Finally in October of 2014, after five years and trillions of dollars, the FOMC stopped the part of the QE program which purchased $85 billion worth of bonds per month in the open market. This came as no surprise to market participants, as the FOMC telegraphed their intention a year earlier. The FOMC agreed that the economy was showing signs of improvement, therefore, some of the accommodative monetary policy could be reigned in to allow the economy to try and stand on its own. Even though the FOMC did not reduce their $4.5 trillion bond portfolio or stop reinvesting the proceeds of maturing bonds, stopping the monthly bond purchase part of QE was considered an important first step towards policy normalization. Additionally, in her post-meeting comments, Federal Chair Yellen hinted at their second move towards normalization, an interest rate increase within a short period of time, presumably on or around September 2015’s FOMC meeting.

Surprisingly, around the September meeting, credit spreads, or the difference between the interest rate on risk-free US Treasury bonds versus corporate bonds and junk bonds, spiked higher. Possibly in consideration of the global implications of higher interest rates, the positive anticipation of the FOMC raising rates, quickly turned into panic. Ironically, the September meeting ended with the FOMC deciding to leave rates unchanged. However, in Chair Yellen’s comments following the decision’s release, she stated that the domestic economy was strong enough to handle higher rates, but that the FOMC’s fear of adverse consequences to the global economy was a contributing factor in their final decision not to raise rates. This was the first time a Federal Reserve Chairman acknowledged such factors in post release comments. The Federal Reserve’s mandate is supposed to be based solely on domestic policy. If they were so concerned about the global economy, that it was a significant factor in their final decision, then maybe something serious was brewing.

The spike in credit spreads may have been the markets trying to forecast both a domestic and global economic slowdown resulting from the lack of liquidity provided by the FOMC. The markets may also have been exclaiming that even after six years of worldwide accommodative monetary policy, the economic landscape may have not strengthened enough to withstand even a partial pullback of accommodative policy. Does that mean our central banks’ domestic policy decisions to reduce stimulative policy materially affects the global economy? The answer is Yes.

By December, Chair Yellen was determined to raise rates in order to move one more step closer to policy normalization. The December meeting was one of the most highly anticipated meetings in many years because the markets had not witnessed an interest rate increase in the federal funds rate since 2006! Concerns were raised once again whether the domestic economy had improved enough, whether the data improved substantially in the previous three months to now justify a rate increase, and whether the concerns over global growth that kept the FOMC from acting in September, had truly abated.

The answer to these concerns may not be known for some time, but in the meantime, a look at various markets’ behavior may provide some indication of their opinion of the policy change. Below is a chart illustrating various markets’ performance from the end of QE3 in October 2014 to the end of the first week in January 2016. Similar to previous market behavior during times of no stimulus, the markets have drifted lower and showed signs of increased vulnerability.

http://www.zerohedge.com/news/2016-01-15/black-friday

In conclusion, the effectiveness of QE (Quantitative Easing) to save the economy and the markets during the crisis is clearly evident. The coordination of the FOMC, the Treasury and the executive branch to effectively put an end to the worst crisis since the Great Depression, was impressive. The actions taken helped investors recover value in their homes and investment accounts that was lost during the recession. However, the insistence by the FOMC to keep an unprecedented amount of stimulus in the domestic economy for so long, has ultimately driven risk assets to extreme levels and has robbed savers of much needed interest income. These market extremes have not been seen since the last bubble top in the year 2000. Many investors are familiar with the damage to their investment accounts after the dot com bubble burst. Additionally, to shape policy in response to market behavior while keeping one eye on global developments has left the stock market and the domestic economy in a precarious state of dependence. While the FOMC is attempting to return to more normal monetary policy, the extension of ZIRP (Zero Interest Rate Policy) for over six years, continued reinvestment of maturing bonds, and the size of their bond holdings present an enormous and risky challenge. With the economy still stuck in the slowest post recession growth rate ever recorded, the uncertainty of the FOMC’s ability to return prosperity to the economy, continue to move towards a more normal policy environment, and keep the markets happy, remains very high.

Author’s Note: Information, news and numbers about our country’s economic health are everywhere. Without a good filter and translator, it is difficult to understand why it matters to you. I stand as your filter, your translator and explainer of the financial jargon that is clogging our airwaves to help you make heads or tails out of its meaning to your situation. My goal is to simplify the meaning, provide perspective, and challenge the context of the information. – Steve DeCesare, CFP®

About Steve DeCesare, CFP®

Founder and President of DeCesare Retirement Specialists

Philadelphia’s leading retirement transition specialist, Steve DeCesare, CFP®, is a second-generation financial planner who has spent the last decade of his career helping professionals transition into retirement with financial confidence.

Philadelphia’s leading retirement transition specialist, Steve DeCesare, CFP®, is a second-generation financial planner who has spent the last decade of his career helping professionals transition into retirement with financial confidence.

His multi-disciplinary planning approach works to ensure that the investment, income, tax and estate strategies are in place to achieve each of his client’s financial and lifestyle goals for retirement. Steve specializes in offering guidance to corporate employees regarding their company sponsored retirement plans such as 401(k)s and pensions. He also advises on rollovers to and investment decisions within Individual Retirement Accounts (IRAs). Additionally, he helps employees who are facing workplace transition with the critical decisions and financial plan adjustments that need to be made to help ensure a smooth progression of their financial life as they enter into their next job or retirement.

DeCesare is a CERTIFIED FINANCIAL PLANNER™ professional and Investment Advisor Representative of DeCesare Retirement Specialists a Registered Investment Advisor, a Registered Representative under Triad Advisors. He is also life and health insurance licensed in the states of New Jersey and Pennsylvania. DeCesare is an approved five star rated advisor with Paladin Registry, a member of the Financial Planning Association (FPA) and a recipient of the 2012, 2013, 2014 and 2015 Five Star Wealth Manager Award. As a financial resource, DeCesare has been quoted in numerous media outlets including USA Today, Money, The Washington Post and Bankrate.com.

For more information about this Update and Steve DeCesare, CFP® please call 856.235.3830 or email Steve@DecesareRetirement.com.